By Graeme Salt

For the first time ever the average dwelling price nationally eclipsed $1 million and these prices are likely to go much higher.

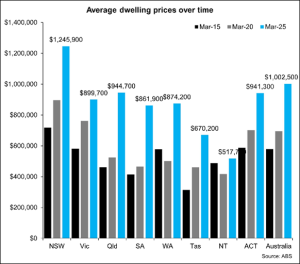

Figures produced by the Australian Bureau of Statistics (ABS) shows major rises in property prices. Over the past five years, national average prices are 44.3 per cent ($307,800) higher with SA (85.2 per cent), Qld (80 per cent) and WA (74.4 per cent) experiencing the greatest increases.

And while interest rates are reducing, these price rises are likely to continue.

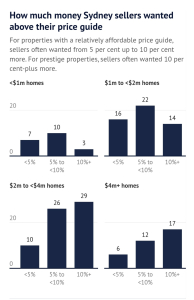

Research by the Sydney Morning Herald (below) shows that many vendors want sale prices as much as 10 per cent above the price guide. And for more prestige properties, the vendor can expect the property to sell for 10 per cent more.

Anecdotally, we are hearing of buyer interest already having increased by 20 per cent since May’s interest rate cut and, with a further cut forecast for July, it is likely to kick-start another spike in prices.

The good news is that the recent interest rate cuts have made some properties more affordable and have boosted Australian’s borrowing capacity.

And this government has been returned to power with a clear policy of making it easier for would-be first home buyers to get on the property ladder.

But it won’t be straightforward. If you want to discuss how you can get on to the property ladder, please contact Graeme for an informal chat.

Graeme Salt is an award-winning mortgage broker. For a no-obligations consultation on your home loan needs, please contact him on 02 9922 5055.